News & Updates

Stay up-to-date with the latest news, articles, webinars and updates from our experts at Tax On Demand. Everything from the latest in tax policy to new feature releases.

How To Prevent Fraud in an Era of AI

In our current era of rapid technological advancement, what used to be considered “tech savvy” is now the new normal. AI is becoming more widespread and new tech developments are

TOD 2025 Wrapped

2025: A Milestone Year For TOD and Lenders As we reflect on the year behind us, it’s clear that 2025 marked a major leap forward for lenders who streamlined their

Benefits of Early Transcript Retrieval

Why Timing Matters: The Case for Early Transcript Retrieval in Lending In lending, every detail matters, and time is of the essence. One critical component that frequently gets overlooked when

From Dated Data to Real-Time Insights

2022 IRS Tax Filings Data This fall, IRS Tax Data was published based on tax filings from 2022. The IRS’s annual corporate tax statistics provide a comprehensive look at the

Government Shutdown

Government Shutdown Stalls Lending, But TOD Keeps Lenders Moving Forward As the longest federal government shutdown in history continues, its ripple effects are being felt across the lending space, particularly

How Tax on Demand Helped NEWITY Become the #1 SBA 7(a) Loan Facilitator

The Cost of Transcript Access The SBA lending arena is highly competitive. Regulations change frequently, borrowers are eager to receive funding quickly, and oversight can cost you money and your

Saving Money on Transcript Access

The Cost of Transcript Access Many lenders often overlook one major price tag in their process that costs them or their clients thousands of dollars. Obtaining tax transcripts from the

Compliance Requirements for Borrower Monitoring and Portfolio Reporting

Elevating the Lender’s Approach to Compliance Since 2020, SBA lenders have experienced a quickly shifting lending environment. From the rapid rollout of PPP and EIDL programs in response to COVID-19,

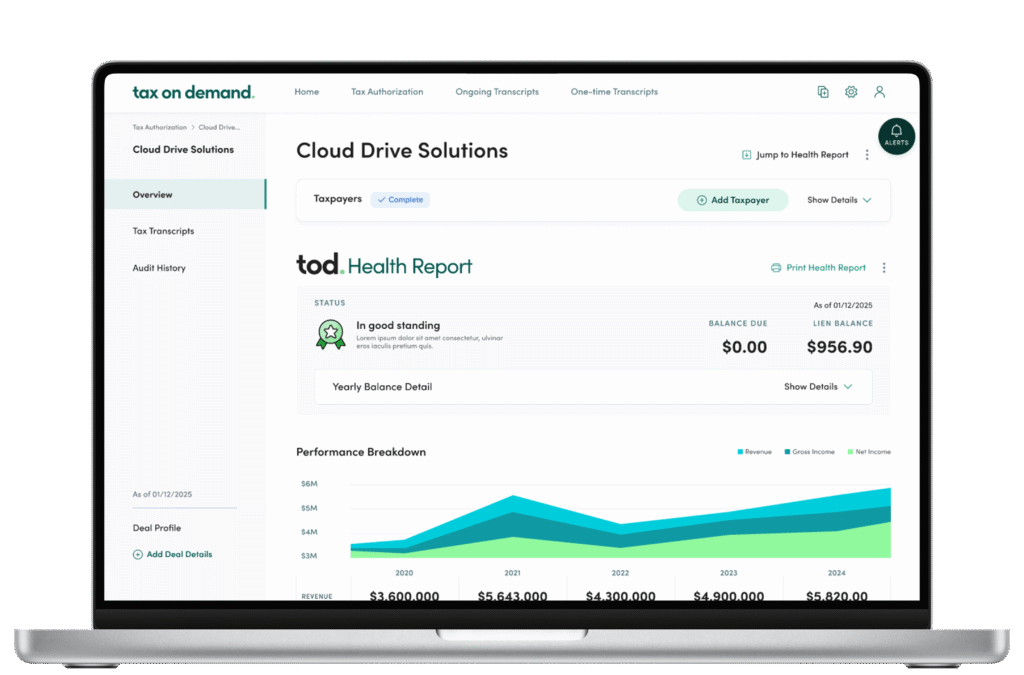

How TOD Helps Lenders Manage Commercial Portfolios

Managing Commercial Loan Portfolios For Lenders As portfolios grow in size and complexity, so do the challenges that come with them. Lenders are tasked with tracking hundreds, sometimes thousands of

Tax Transcripts vs. Tax Returns — Which is Better?

Collecting Client Financial Data When accessing your clients’ financial records, transparency and accuracy are everything. Whether you’re reviewing documents for a loan application or advising your client on their tax